How a Silent Debt Crisis is Threatening the World’s Poorest Countries

The Debt Crisis You Haven’t Heard About Could Be the Next Global Catastrophe!

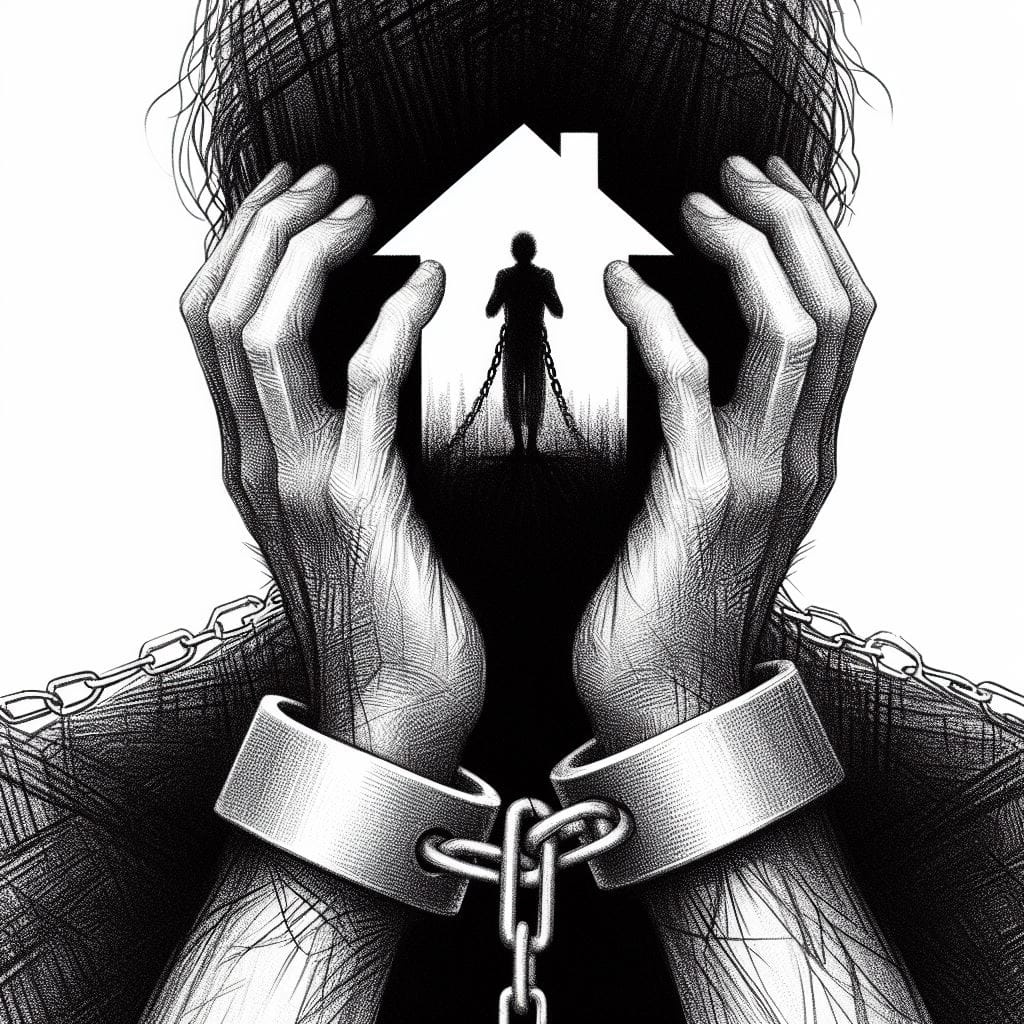

Imagine you are a farmer in a developing country. You have a small plot of land where you grow crops to feed your family and sell at the local market. You also have a loan from a bank that you used to buy seeds, fertilizer, and tools. You pay interest on the loan every month, and you hope to pay it off in a few years.

Now imagine that one day, the interest rate on your loan suddenly goes up. A lot. You don’t know why, but you hear that it has something to do with what is happening in the United States, thousands of miles away. The US economy is booming, and the US central bank is raising interest rates to prevent inflation. This affects the global cost of borrowing, especially for countries like yours that borrow in US dollars.

You are shocked and worried. You can barely afford to pay the higher interest on your loan, let alone the principal. You have to cut back on your expenses, sell some of your assets, and hope for a good harvest. You also hope that the interest rate will go down soon, so you can get out of this debt trap.

But it doesn’t. The interest rate stays high for months, even years. You are not alone. Many other farmers, businesses, and households in your country are in the same situation. Your country’s government is also struggling to pay its debts, which have piled up over the years. It has to borrow more money to pay the interest, but no one wants to lend to it at a reasonable rate. It has to cut spending on public services, raise taxes, and devalue its currency. This makes life harder for everyone, especially the poor and vulnerable.

This is not a hypothetical scenario. This is the reality for 28 developing economies that have the weakest credit ratings in the world. They are stuck in a silent debt crisis that has no easy way out. They account for a quarter of all developing economies with credit ratings and 16% of the global population. However, their collective economic activity constitutes a mere 5% of global output, which makes it easy for the rest of the world to ignore their predicament. Their debt crisis, as a result, is silent—and it could intensify.

In this blog post, we will explain how this silent debt crisis came about, what its consequences are, and what can be done to solve it. We hope you will learn something new and valuable from reading this post.

Read my other posts here: Conventional Finance - FinFormed, Islamic Finance - FinFormed, Takaful - FinFormed, Career - FinFormed and Randow Writings - FinFormed

How did the silent debt crisis start?

The silent debt crisis has its roots in the global financial crisis of 2008-09, which triggered a wave of stimulus measures by advanced economies to revive their economies. These measures included lowering interest rates to near zero and buying large amounts of bonds to inject money into the financial system. This made borrowing cheaper and easier for everyone, including developing economies.

Many developing economies took advantage of this opportunity to borrow money from international investors, who were looking for higher returns in a low-interest environment. They issued bonds denominated in major currencies of advanced economies, such as the US dollar, the euro, and the yenmeant. These bonds offered attractive interest rates and were in high demand.

Between 2010 and 2019, developing economies issued more than $2 trillion worth of bonds in foreign currencies, more than double the amount in the previous decade. Some of them used the money to invest in infrastructure, education, health, and other productive sectors. Others used it to finance budget deficits, pay off old debts, or build up foreign reserves. Some also used it to fund wasteful spending, corruption, or political patronage.

The problem with borrowing in foreign currencies is that it exposes the borrower to exchange rate risk. If the local currency depreciates against the foreign currency, the debt becomes more expensive to repay. This can happen for various reasons, such as changes in economic fundamentals, market sentiment, or external shocks.

For example, in 2014-15, many developing economies faced a sharp drop in commodity prices, which reduced their export earnings and weakened their currencies. In 2020, the COVID-19 pandemic caused a global recession, which reduced trade, tourism, and remittances, and triggered capital outflows from developing economies. These events increased the pressure on their currencies and their debt burdens.

Meanwhile, the US economy recovered faster than expected from the pandemic, thanks to its massive fiscal and monetary stimulus. This led the US central bank to tighten its monetary policy, which meant raising interest rates and reducing its bond purchases. This increased the global cost of borrowing, especially for developing economies that borrow in US dollars.

The combination of these factors created a perfect storm for the 28 developing economies with the weakest credit ratings. Their cost of borrowing increased sharply over the past two years: they now face interest rates roughly 20 points above the global benchmark rate and more than nine times that for other developing economies. They have been locked out of global capital markets for more than two years. They have issued almost no international bonds during that time, a barren spell of the kind not seen since the global financial crisis. Not surprisingly, 11 of them have defaulted since 2020, approaching the total of the previous two decades.

What are the consequences of the silent debt crisis?

The silent debt crisis has severe economic and social consequences for the affected countries and their people. By the end of 2024, people in nearly half of developing economies with weak credit ratings will be poorer on average than they were in 2019, on the eve of the COVID-19 pandemic. For developing economies with better credit ratings, the comparable share is just 8%. Prospects are unlikely to improve anytime soon: developing economies with weak ratings will grow nearly a full percentage point more slowly over 2024-25 than they did in the decade before the pandemic.

The high debt burden limits the ability of these countries to respond to the pandemic and its aftermath. They have less fiscal space to support their health systems, protect their vulnerable populations, and stimulate their economies. They have less monetary space to lower interest rates, stabilize their exchange rates, and prevent inflation. They have less external space to access foreign financing, trade, and investment.

The high debt burden also increases the risk of social unrest, political instability, and humanitarian crises. Many of these countries already face multiple challenges, such as poverty, inequality, conflict, violence, climate change, and migration. The debt crisis adds to their fragility and vulnerability, and could trigger a vicious cycle of economic decline, social discontent, and political turmoil.

The silent debt crisis also has spillover effects for the rest of the world. It could undermine global efforts to achieve the Sustainable Development Goals, which aim to end poverty, protect the planet, and ensure peace and prosperity for all by 2030. It could also pose a threat to global financial stability, especially if it spreads to other developing economies or triggers contagion in the international financial system.

What can be done to solve the silent debt crisis?

The silent debt crisis requires urgent and coordinated action from both the debtor countries and the international community. There is no one-size-fits-all solution, but some general principles and steps can be followed.

First, the debtor countries need to implement sound macroeconomic policies and structural reforms to restore economic stability, attract investment, and promote growth. This means broadening their revenue bases, prioritizing their spending, reducing their fiscal deficits, and enhancing their debt management. It also means adopting credible exchange rate regimes, strengthening their central bank independence, and maintaining price stability. Moreover, it means improving the quality of their institutions, governance, and business environment, and addressing the root causes of their fragility and vulnerability.

Second, the debtor countries need to seek debt relief from their creditors, where necessary and feasible. This means engaging in good faith negotiations with their creditors, based on a comprehensive and realistic assessment of their debt sustainability and repayment capacity. It also means seeking the support of multilateral institutions, such as the International Monetary Fund, the World Bank, and the United Nations, to facilitate the debt restructuring process and provide technical and financial assistance.

Third, the international community needs to provide more and better support to the debtor countries, in terms of debt relief, financing, and policy advice. This means enhancing the existing initiatives, such as the G20 Debt Service Suspension Initiative and the Common Framework for Debt Treatments, to make them more inclusive, flexible, and effective. It also means mobilizing more resources, such as grants, concessional loans, special drawing rights, and debt swaps, to help the debtor countries cope with the pandemic and its aftermath. Moreover, it means improving the global framework for debt restructuring, to make it more transparent, fair, and efficient.

The silent debt crisis is a serious challenge for the world’s poorest countries and their people. It is also a test for the world’s solidarity and cooperation. If we act together, we can help them overcome this challenge and achieve a more sustainable, inclusive, and resilient future.

Summary

- The silent debt crisis is affecting 28 developing economies with the weakest credit ratings, who are stuck in a debt trap with no hope of escape anytime soon.

- The silent debt crisis started with the global financial crisis of 2008-09, which triggered a wave of cheap borrowing by developing economies, and worsened with the COVID-19 pandemic, which increased the global cost of borrowing and reduced their economic activity.

- The silent debt crisis has severe economic and social consequences for the affected countries and their people, who face lower growth, higher poverty, and greater fragility. It also has spillover effects for the rest of the world, which could undermine global development and stability.

- The silent debt crisis requires urgent and coordinated action from both the debtor countries and the international community, in terms of sound policies, debt relief, and financing. It also requires improving the global framework

Disclaimer: The views expressed in this blog are not necessarily those of the blog writer and his affiliations and are for informational purposes only.

If you found this blog post insightful, don’t forget to subscribe to our website for more updates on Finance. Your subscription will help us continue to bring you the latest insights into the world of finance. And if you think this post could benefit others, please feel free to share it. Let’s spread the knowledge together!