Is Riba (interest/usury) limited to loans only or it can happen in a sale contract too?

Learn about the concept of Riba in Islamic finance, including two types of riba (riba al-nasiyah and riba al-fadl) and its impact on loan, borrowing and sale transactions from a Shariah perspective.

Riba is Arabic for excess, increase, or addition. It may be understood as an excess compensation or an unjustified return in a loan, borrowing, or sale transaction from a Shariah perspective. The most typical example is taking out a loan from a traditional bank: the bank lends money, and the borrower repays it later with a portion more than the original amount.

But riba is not limited to an increase in a loan contract.

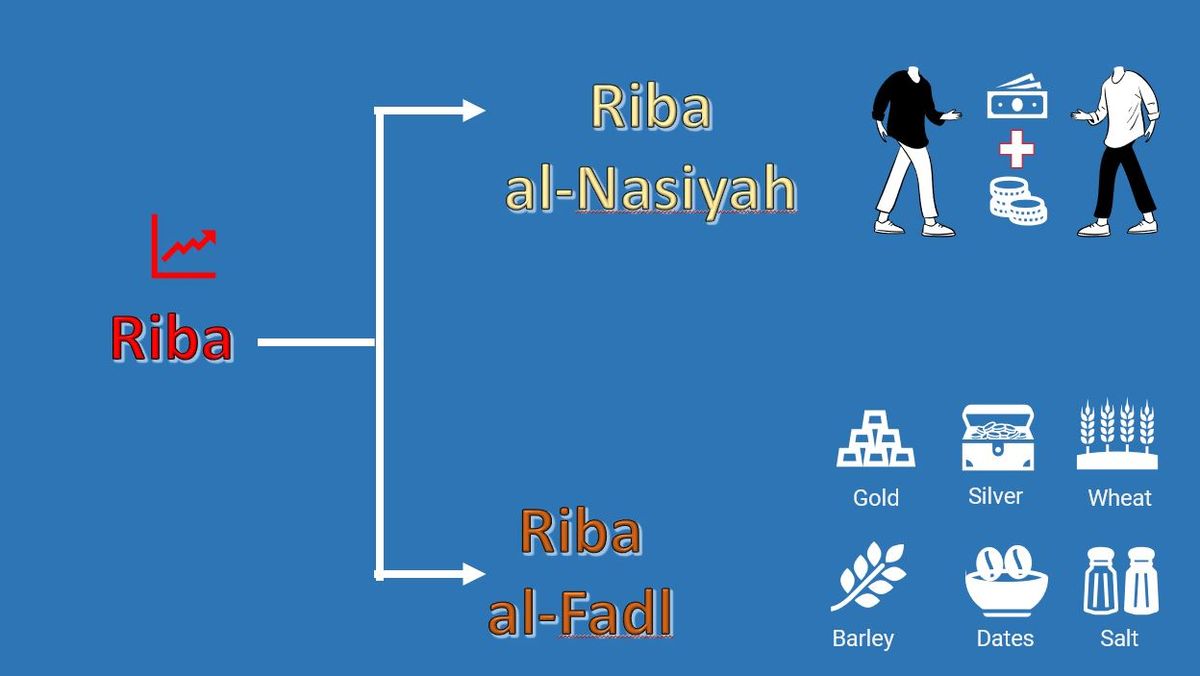

Broadly, there are two types of riba:

- riba in loan contract (Riba al-Nasiyah)

- riba in sale or exchange contract (Riba al-Fadl)

Riba in loan contract (riba al-nasiyah)

This is the riba that is most widely recognised. As the borrower pays the loan later, the lender charges a higher payment than the initial loan amount.

Whether the excess or additional is specified at the beginning of the contract or at the end (in case the borrower defaults) is irrelevant. Any pre-determined or pre-agreed increase or any additional sum charged by the lender beyond the initial loan amount will be considered as Riba. Because the Quran expressly forbade this kind of riba, which was widely used in Arab culture at the time, it is known as riba al-Quran.

What if a borrower repays the money, but offers some gift as gratitude?

It is allowed. However, the condition is it cannot be pre-agreed and the lender cannot demand. It has to come from the borrower as free will.

Riba in sale contract (riba al-Fadl)

This type of Riba happens in a sale or exchange transaction of a commodity. This type of riba only applies to commodities mentioned in the Hadith:

“Gold for gold, silver for silver, wheat for wheat, barley for barley, date for date, salt for salt, must be equal on both sides and hand to hand, whoever pays more or demands more (on either side) indulges in Riba” [Sahih Muslim].

The sale of the above products will be considered as Riba if they fail to follow the following conditions:

- The transaction has to be spot and no delays are allowed.

- The transaction has to be for the same quality and quantity. No changes can be made in terms of inferior or superior quality of exchanges. No difference in quantity.

Is Credit Sale (Murabaha/Musawwama) Riba?

As long as the product, price and payment are agreed upon during the contract it is permissible. For example:

X is selling a pen to Z and said I will charge you Taka 1 if you pay me now and Taka 1.5 if you pay me 1 week later. As long as the price and payment are agreed this is a valid sale and there's no riba.

Adopted from: https://blossomfinance.com/posts/basics-of-riba-interest-and-its-two-major-types

If you find this post helpful or interesting, please share it.